For many businesses, commission clawbacks are an essential part of ensuring financial stability and accountability. However, when poorly implemented, clawbacks can quickly lead to dissatisfaction and demotivation within a salesforce.

A recent article highlights how large corporations, with market caps of $10 billion or more, apply clawbacks that go beyond the SEC’s requirements. According to an analysis by FW Cook, nearly 80% of these companies target more executives and more types of compensation than the SEC mandates. These clawbacks are triggered not only by financial restatements but also by instances of misconduct, reputational damage, and violations of company policy.

While these measures protect company interests, they can also demoralize employees, particularly sales teams whose compensation is tied to performance. The challenge lies in implementing commission clawbacks in a way that safeguards both company finances and employee morale. In this blog, we’ll explore how businesses can adopt best practices to create fair, transparent, and motivating commission clawback policies.

What Are Commission Clawbacks?

Commission clawbacks refer to the practice of reclaiming commissions that have already been paid to sales representatives. This typically happens when certain conditions related to a sale are not met, such as a contract being canceled, a customer requesting a refund, or a product return.

Common Scenarios for Clawbacks

Commission clawbacks are usually applied in these situations:

- Customer cancellations: The client cancels a subscription, agreement, or service shortly after the deal is closed.

- Refunds or chargebacks: The customer demands a refund or disputes the payment, leading to lost revenue.

- Unfulfilled terms: The sale fails to meet predefined terms, such as minimum contract duration or usage thresholds.

Why Are Clawbacks Necessary?

For businesses, clawbacks are a financial safeguard. They ensure that sales commissions align with actual revenue and profitability. Without clawbacks, companies could face financial imbalances, particularly in industries with recurring revenue models or long sales cycles.

While clawbacks are vital for protecting the bottom line, implementing them carefully is key to maintaining trust and motivation within your salesforce.

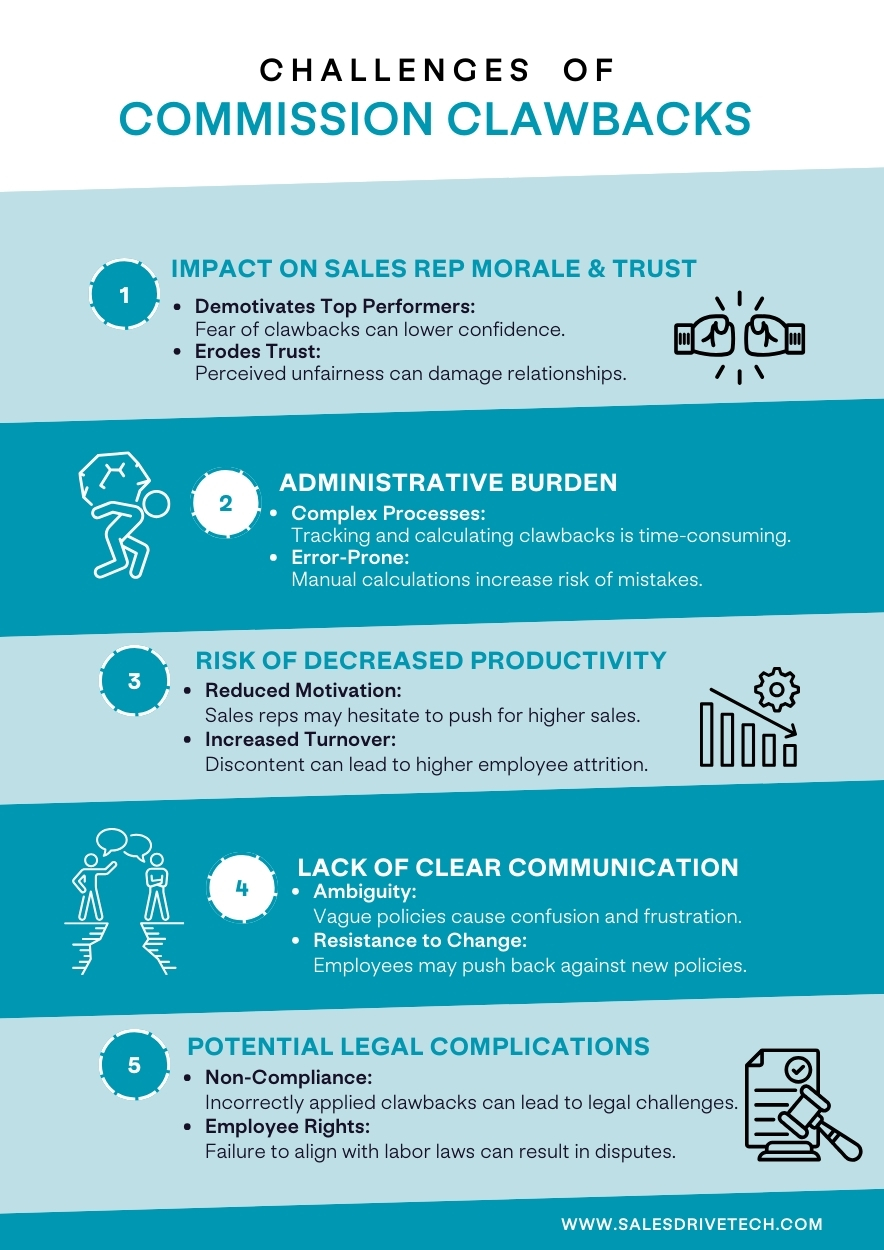

Infographic: Challenges of Commission Clawbacks

- Impact on Sales Rep Morale & Trust

- Demotivates Top Performers: Fear of clawbacks can lower confidence.

- Erodes Trust: Perceived unfairness can damage relationships.

2. Administrative Burden

- Complex Processes: Tracking and calculating clawbacks is time-consuming.

- Error-Prone: Manual calculations increase risk of mistakes.

3. Risk of Decreased Productivity

- Reduced Motivation: Sales reps may hesitate to push for higher sales.

- Increased Turnover: Discontent can lead to higher employee attrition.

4. Lack of Clear Communication

- Ambiguity: Vague policies cause confusion and frustration.

- Resistance to Change: Employees may push back against new policies.

5. Potential Legal Complications

- Non-Compliance: Incorrectly applied clawbacks can lead to legal challenges.

- Employee Rights: Failure to align with labor laws can result in disputes.

The 5 Best Practices for Implementing Clawbacks

To successfully navigate the above-mentioned challenges, businesses must strategically implement commission clawbacks in a way that balances financial protection with employee motivation. By following these best practices, businesses can ensure that clawbacks are applied fairly and effectively.

a. Draft Clear and Transparent Policies

Clear and transparent policies are foundational to implementing effective commission clawbacks. Sales reps need to understand exactly when and why clawbacks might occur.

- Include precise terms in employment contracts: Detail the conditions under which clawbacks will apply, ensuring there are no ambiguities.

- Provide examples of scenarios: Clarify the types of situations (e.g., customer returns, contract cancellations) that would trigger clawbacks.

- Open communication: Transparency is key to acceptance. Regularly communicate the rationale behind clawback policies to prevent misunderstandings and ensure buy-in from the sales team.

-

Seek Legal Guidance

Clawbacks must be legally sound to be effective and fair. Seeking legal advice ensures that the policies comply with applicable labor laws and are enforceable.

- Legal compliance is critical: Understanding the laws governing compensation and clawbacks protects the business from potential legal challenges.

- Navigate labor laws and employee rights: Ensure that the policies are designed to meet both local and federal employment laws while respecting employee rights.

- Ensure enforceability and fairness: A legal expert can help you structure policies that are not only compliant but also fair and reasonable, preventing potential disputes.

c. Set Reasonable Clawback Parameters

Setting overly aggressive clawback parameters can demotivate your sales team and result in unnecessary friction.

- Avoid overly aggressive policies: Balance the need for protecting company revenue with the need to maintain employee trust and motivation.

- Balance protection and trust: While clawbacks help manage financial risk, they should not undermine the compensation system’s integrity.

- Criteria and limits: Set clear parameters such as timeframes (e.g., within 90 days after the sale) and percentage limits for reclaimed commissions to ensure fairness.

d. Educate and Communicate with Your Salesforce

One of the best ways to ensure the success of clawbacks is by fostering understanding and trust through education and communication.

- Explain the “why” behind clawbacks: Help your sales team understand the business rationale behind commission clawbacks, such as protecting the company from financial instability.

- Training sessions and resources: Offer training to ensure that sales reps understand the policies and know how to avoid situations that could lead to clawbacks.

- Open feedback loop: Encourage sales reps to voice concerns and feedback about the policies, which helps refine and improve the system over time.

e. Automate the Clawback Process

Leverage technology to simplify and streamline the clawback process. Automation not only improves accuracy but also minimizes the administrative burden associated with manual calculations.

- Benefits of automation: Automation tools ensure that clawbacks are processed efficiently and consistently, reducing errors and saving time.

- Tools for automation: Utilize incentive automation software to handle calculations and ensure that policies are applied correctly.

- Consistency and efficiency: Automation guarantees that all sales reps are treated equally and that the clawback process remains transparent, fast, and error-free.

By following these best practices, businesses can implement commission clawbacks in a way that protects revenue without demotivating or alienating their sales teams.

Final Thoughts

Commission clawbacks are essential for protecting company finances and ensuring long-term stability.As businesses continue to refine their clawback policies, aligning them with both internal goals and external regulations ensures that the policies are fair, transparent, and effective. Exploring automation tools can further streamline the clawback process, making it more efficient and consistent.

By adopting these best practices, companies can not only maintain compliance but also foster a culture of fairness and trust, ultimately driving long-term success.